Auto Dealer Bonds from Manav Pietro's blog

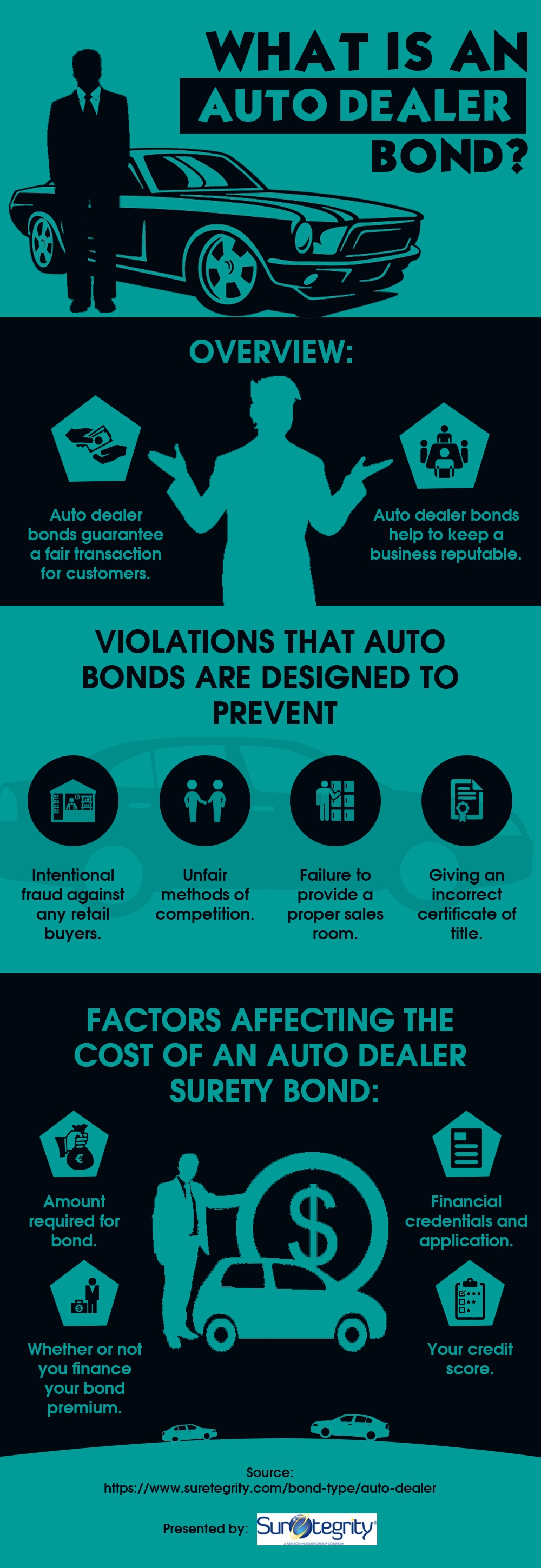

This info-graphic titled ‘Auto Dealer Bonds’ provides us an overview of surety bonds required for auto industry. Many Americans rely on their automobiles for just about every aspect of routine life. So it’s incredibly all-important that the vehicles which take parents to work and kids to school be sold-out and serviced by licensed, accountable business people.

Auto Dealer Bondsare a common requirement for many kinds of businesses that deal with motor vehicles sales and service. These bonds help defend the customer and driver while keeping auto industry businesses accountable. Businesses including new and used motor vehicle dealers, brokers, wholesalers, and auto parts dealers may have to buy in any of the different types of surety bonds before they can acquire a license from state or local authorities.

Each state requires different terms and bond amounts for an auto dealer surety, and many states also necessitate slightly different bond types for various types of auto franchises. Used vehicle dealerships, new vehicle dealerships, salvage dealerships, and auto auctions all typically fall into antithetic classes. A business buying an auto dealer surety bond should be sure to check the particular bond requirements for their business category. For more information, please refer to the info-graphic below.

Post

| By | Manav Pietro |

| Added | Nov 28 '21 |

Tags

Rate

Archives

- All

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- May 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- May 2021

- March 2021

- February 2021

- January 2021

- September 2020

- August 2020

- July 2020

- June 2020

- April 2020

- March 2020

- January 2020

- November 2019

- September 2018

- August 2018

- July 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- February 2017

- August 2016

- July 2016

The Wall